Did you know?

Did you know?

- 2/3 of American adults can’t pass a basic financial literacy test.

- 44% of Americans don’t have enough cash to cover a $400 emergency.

- 43% of student loan borrowers are not making payments.

- 38% of U.S. households have credit card debt. On average, they owe $16,048.

- 33% of American adults have $0 saved for retirement.

These statistics are from a recent Forbes article on how badly America is failing at financial literacy. They are for all Americans not just for those who have literacy problems. For low-literate adults, the challenge to understand and manage finances is even greater.

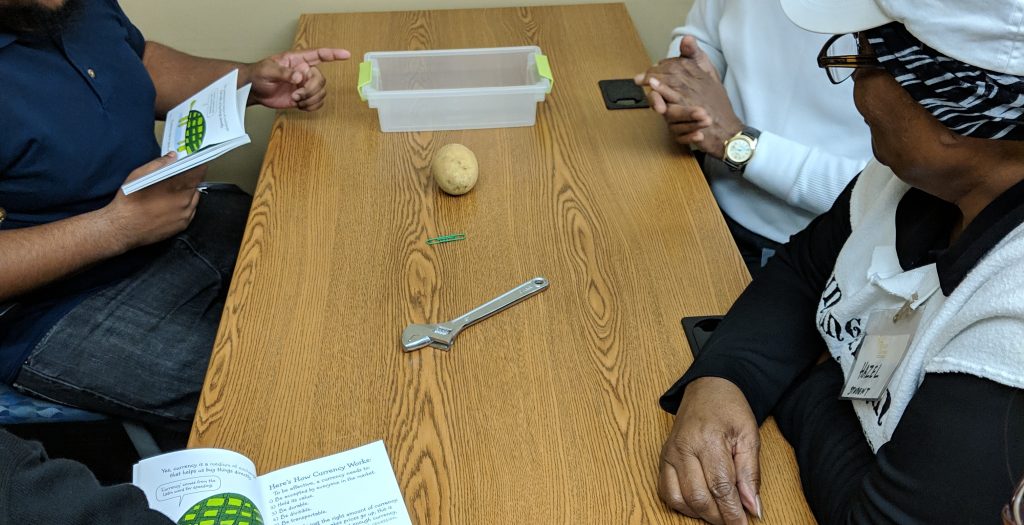

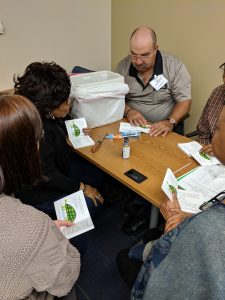

Recognizing the need for financial literacy, READ Center teacher Janet used the Guy Fox History Project book, How the World Really Works: Savings, Investments and Pensions, to begin a discussion and lesson on currency. Understanding currency is important to understand money and finances.

From Janet:

“Tuesday, we learned the criteria for what makes a good currency. Tonight, we came up with our class currency. We divided into 3 groups and I gave each group some random items- stock pot, rubber band, onion, socket, etc. The rule was no paper. They could use the items I selected or anything else they found. Each group decided  what they wanted to nominate for the class currency. We then, as a large group, made our final decision- the paperclip. It is durable, holds its value, easily transported and you can use different colors and sizes to denote different values.”

what they wanted to nominate for the class currency. We then, as a large group, made our final decision- the paperclip. It is durable, holds its value, easily transported and you can use different colors and sizes to denote different values.”

The READ Center, with the help and support of Union Bank and Trust, developed a financial literacy class for low-literate adults last summer. Willis Towers and Watson, who helped to develop the Savings, Investments and Pensions book, donated copies of the book to The READ Center for the class. READ will offer financial literacy classes to students and the community in 2019.

Thank you, Union Bank and Trust and Willis Towers Watson, for supporting financial literacy and for your support of financial literacy for low-literate adults.